Establishing a lasting financial routine is crucial for achieving your long-term financial goals. This comprehensive guide will walk you through the essential steps to build a sustainable financial plan, covering everything from budgeting and saving to investing and debt management. Learn how to develop healthy financial habits that will empower you to take control of your finances and secure your financial future.

Why Routines Help Improve Financial Discipline

Establishing a financial routine fosters discipline by creating a structured approach to managing money. This structured approach reduces the likelihood of impulsive spending and promotes consistent saving and investing habits.

Automation is a key component. Automating bill payments and regular contributions to savings accounts removes the reliance on willpower, a frequently unreliable resource for long-term financial success. This consistent action, ingrained through routine, builds momentum and strengthens your financial habits.

Routines also facilitate regular monitoring of your finances. By setting aside dedicated time each week or month to review your budget, track expenses, and assess your progress, you maintain awareness of your financial health. This proactive approach enables timely adjustments and prevents unexpected financial shocks.

Ultimately, a well-established financial routine cultivates mindfulness about your spending and investment decisions. It encourages proactive planning and reduces the stress often associated with haphazard financial management. This, in turn, significantly improves your overall financial discipline.

Choose a Set Time Each Week for Money Review

Establishing a consistent time for reviewing your finances is crucial for building a lasting financial routine. Consistency is key; treat this review like any other important appointment.

Choose a day and time that works best with your schedule. Whether it’s Sunday evening, Wednesday lunchtime, or Friday afternoon, the important factor is regularity. This dedicated time allows you to monitor your spending, track your progress toward financial goals, and identify any potential issues early on.

During this review, examine your bank statements, credit card transactions, and any other relevant financial documents. Note any unexpected expenses or areas where you could potentially save. This proactive approach prevents financial surprises and allows for timely adjustments to your budget.

By scheduling a regular financial review, you’ll foster a stronger sense of financial awareness and control. This dedicated time is essential for maintaining a healthy financial routine that endures.

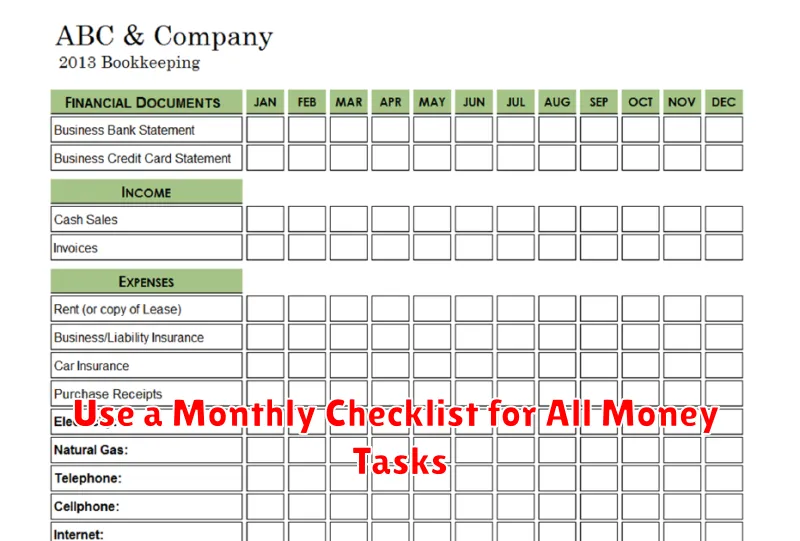

Use a Monthly Checklist for All Money Tasks

A monthly checklist is crucial for maintaining a consistent financial routine. It ensures you don’t overlook important tasks and helps you stay organized.

Include items like reviewing your budget, checking your bank and credit card statements for discrepancies, paying bills on time, and contributing to your savings and investment accounts.

Monitoring your spending habits through monthly reviews allows for timely adjustments to your budget, preventing overspending and promoting financial stability. This proactive approach helps you stay on top of your finances and achieve your financial goals.

Consider adding tasks like reviewing your investment portfolio performance, checking your credit score, and planning for upcoming expenses. A personalized checklist tailored to your specific financial needs ensures maximum effectiveness.

Using a checklist fosters accountability and helps build a lasting financial routine. The act of checking off completed tasks provides a sense of accomplishment and reinforces positive financial habits.

Automate What You Can to Reduce Stress

Building a lasting financial routine requires consistent effort, but automation can significantly reduce the associated stress. By automating various financial tasks, you free up mental space and time for other important aspects of your life.

Consider automating bill payments. Setting up automatic payments ensures timely payments, preventing late fees and the anxiety of forgetting deadlines. Similarly, automating savings contributions, such as regularly transferring funds to a savings or investment account, simplifies saving and makes it less susceptible to procrastination.

Investing can also be automated. Many brokerage platforms offer automated investment plans, allowing you to set parameters and automatically invest at regular intervals. This eliminates the need for constant monitoring and decision-making, significantly reducing stress.

Budgeting apps can further aid in automation. These apps connect to your bank accounts and track your spending, providing insights into your financial habits and automatically categorizing your expenses. This allows for more informed decision-making and proactive financial management.

By implementing these automation strategies, you create a sustainable and stress-free financial routine, allowing you to focus on achieving your long-term financial goals with greater ease.

Reflect on What Worked and What Didn’t

Building a lasting financial routine requires consistent self-reflection. Honest evaluation is key to identifying effective strategies and areas needing improvement. What specific techniques, such as budgeting apps or regular saving transfers, proved successful? Note the reasons for their effectiveness – did they align with your personality and lifestyle? Conversely, pinpoint elements that failed. Was the chosen method too complex, inflexible, or simply unmotivating? Understanding these aspects allows for refined adjustments and ensures long-term adherence to your financial plan.

For instance, if a rigid budgeting app caused frustration, consider switching to a simpler method or focusing on goal-oriented savings. Perhaps automating savings worked well, but lacked flexibility for unexpected expenses; you might then explore incorporating a small emergency fund. The process of reflection should be iterative, continuously adapting your approach based on your experiences and changing circumstances.

This reflective process isn’t about self-criticism; it’s about learning and optimizing. By honestly assessing both successes and failures, you gain valuable insight into your personal financial behaviors and preferences, paving the way to create a truly sustainable and effective financial routine. Remember that consistency and adaptation are the cornerstones of long-term financial success.

Include Review of Goals and Progress

Regularly reviewing your financial goals and progress is crucial for maintaining a lasting financial routine. This involves more than just checking your account balance; it requires a thoughtful assessment of your financial objectives.

Schedule a dedicated time, perhaps monthly or quarterly, to examine your budget, comparing actual spending to planned spending. Analyze your investment performance, noting any deviations from projections. Identify areas where you’re excelling and areas needing improvement.

This review process isn’t merely about numbers; it’s about understanding your behavior. Did unexpected expenses derail your savings goals? Did you successfully stick to your investment strategy? These insights allow you to adjust your approach, ensuring your financial routine adapts to your evolving needs and circumstances.

By actively reviewing your progress and making necessary adjustments, you maintain motivation and build the resilience needed to navigate life’s financial challenges. This consistent reflection is key to achieving long-term financial success.

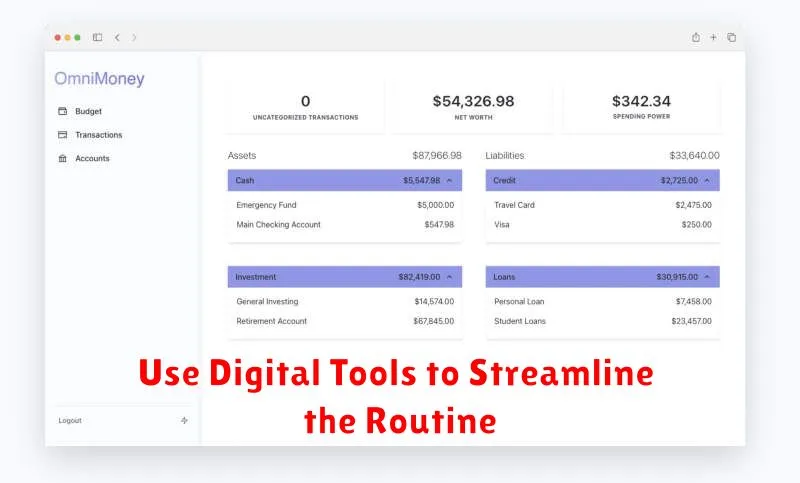

Use Digital Tools to Streamline the Routine

Digital tools can significantly enhance your financial routine’s efficiency and effectiveness. Budgeting apps like Mint or YNAB (You Need A Budget) automate tracking of income and expenses, providing clear visualizations of your spending habits.

Automated savings are simplified through features offered by many banking apps, enabling recurring transfers to savings or investment accounts. This eliminates the need for manual transfers, ensuring consistent savings growth.

Investment platforms like Robinhood or Fidelity provide user-friendly interfaces for managing investments. These platforms often offer features such as automated investing and portfolio tracking, simplifying investment management.

Bill payment apps and online banking systems allow for scheduled payments, preventing late fees and improving cash flow management. Consolidating bill payments into a single system streamlines the process and reduces administrative burden.

By leveraging these digital solutions, you can build a robust, efficient, and sustainable financial routine, freeing up valuable time and mental energy for other priorities.

Reward Yourself for Staying Consistent

Maintaining a strong financial routine requires discipline and commitment. To stay motivated and prevent burnout, it’s crucial to incorporate a system of rewards. These rewards shouldn’t be extravagant; rather, they should be small, attainable treats that acknowledge your progress and reinforce positive behavior.

Consider linking your rewards directly to your financial goals. For example, after consistently saving for three months, reward yourself with a massage or a nice dinner. Reaching a larger milestone, like paying off a significant debt, justifies a more substantial reward, perhaps a weekend getaway or a new item you’ve been wanting. The key is to make the reward proportionate to the achievement.

The type of reward is less important than its connection to your effort. Choose something you genuinely enjoy and will look forward to, ensuring it doesn’t undermine your financial progress. This system of positive reinforcement strengthens your commitment and makes the journey towards financial well-being more sustainable and enjoyable.