Building financial confidence can feel daunting, but it’s achievable through a structured, step-by-step approach. This guide provides practical strategies to help you gain control of your finances, reduce financial stress, and cultivate a positive relationship with money. Learn how to budget effectively, eliminate debt, save and invest wisely, and ultimately achieve your financial goals with confidence. Discover the secrets to building wealth and achieving long-term financial security, empowering you to make informed financial decisions for a brighter future.

Understand Your Relationship With Money

Building financial confidence starts with understanding your relationship with money. This involves honestly assessing your spending habits, identifying your financial values, and recognizing any emotional triggers related to finances.

Do you tend to overspend when stressed? Do you avoid budgeting because it feels restrictive? Are you a saver or a spender by nature? Understanding these underlying patterns is crucial. Consider keeping a detailed spending journal for a month to track where your money goes. This exercise provides valuable insights into your spending habits and helps you identify areas for improvement.

Reflect on your relationship with money from a young age. Were you taught about financial responsibility? What are your beliefs about money – is it a source of stress or security? Understanding these beliefs, whether positive or negative, is a key step towards building a healthier financial future. Acknowledging any emotional baggage around money allows you to address it constructively and develop a more positive relationship with your finances.

Once you understand your spending patterns and emotional responses to money, you can begin to make informed decisions about your financial future, setting realistic goals, and building the confidence to manage your finances effectively.

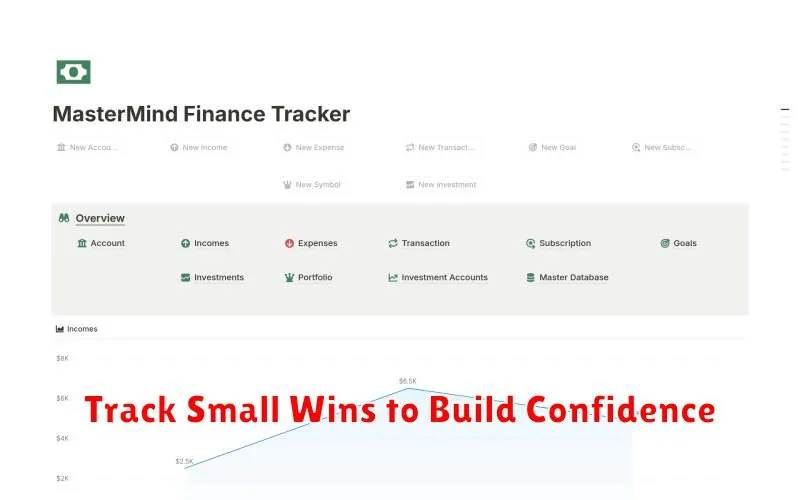

Track Small Wins to Build Confidence

Building financial confidence is a journey, not a destination. One of the most effective strategies is to track your small wins. These seemingly insignificant achievements accumulate to create a powerful sense of accomplishment and momentum.

Start by identifying small, achievable financial goals. This could be anything from paying off a small debt to consistently saving a certain amount each month, or even successfully sticking to a budget for a week. Once achieved, celebrate these milestones! This positive reinforcement is crucial for building confidence.

Keep a record of your progress. A simple spreadsheet, journal, or even a notes app on your phone will suffice. Seeing your accomplishments visually documented will further boost your morale and provide tangible proof of your financial progress. This visual representation of your success acts as positive reinforcement, fueling your motivation.

Remember, consistency is key. Regularly reviewing your progress and acknowledging your achievements, no matter how small, will significantly contribute to building lasting financial confidence.

Celebrate Progress, Not Perfection

Building financial confidence is a journey, not a race. It’s crucial to avoid the trap of striving for unattainable perfection. Instead, focus on celebrating every milestone achieved, no matter how small.

Did you successfully stick to your budget this month? Celebrate it! Did you pay off a small debt? Acknowledge your accomplishment. These small victories, when consistently recognized, build momentum and reinforce positive financial habits.

Perfectionism often leads to discouragement and inaction. A single setback can derail your efforts if you’re fixated on flawless execution. By focusing on progress, you maintain motivation and build resilience in the face of challenges.

Remember that setbacks are a normal part of the process. Learn from your mistakes, adjust your strategy, and keep moving forward. Celebrate your resilience and the lessons learned along the way. This approach fosters a sustainable and positive relationship with your finances.

Learn Basic Financial Concepts One at a Time

Building financial confidence starts with understanding fundamental concepts. Don’t try to learn everything at once; instead, focus on mastering one concept at a time.

Begin with budgeting. Track your income and expenses to understand where your money goes. A simple spreadsheet or budgeting app can be invaluable. This provides a clear picture of your financial health.

Next, grasp the importance of saving. Establish an emergency fund to cover unexpected expenses. Even small, regular contributions add up over time. This builds a crucial safety net and reduces financial stress.

Then, learn about debt management. Understand different types of debt (credit cards, loans) and their associated interest rates. Prioritize paying down high-interest debt to minimize long-term costs.

Finally, explore investing. Start with learning about different investment vehicles like stocks, bonds, or mutual funds. Understand risk tolerance and diversify your investments to minimize potential losses. Consider seeking professional advice if needed.

By mastering these core concepts sequentially, you’ll build a strong foundation for making informed financial decisions and, ultimately, achieving greater financial security and confidence.

Avoid Comparing Yourself to Others

Financial confidence is a deeply personal journey. Comparing your financial situation to others is detrimental and often unproductive. Everyone’s circumstances, including income, expenses, and financial goals, are unique. Focusing on others’ progress can lead to feelings of inadequacy and hinder your own progress.

Instead of comparing, focus on your own financial goals and progress. Celebrate your achievements, no matter how small, and learn from any setbacks. Remember that building financial confidence is a marathon, not a sprint, and your pace is your own.

Develop a realistic budget and stick to it. Track your spending habits and identify areas where you can save. This will give you a sense of control and build confidence in your ability to manage your finances. Using budgeting apps or spreadsheets can enhance this process.

Seek professional financial advice if needed. A financial advisor can provide personalized guidance and support, helping you create a plan that aligns with your goals and risk tolerance. This can significantly boost your confidence in handling your finances.

Set a Weekly Money Check-In with Yourself

Regularly reviewing your finances is crucial for building financial confidence. A weekly check-in, even if brief, provides valuable insight and control.

Schedule a specific time each week – perhaps Sunday evening or Friday afternoon – to dedicate to this process. This consistent approach fosters a habit of financial awareness.

During your check-in, review your spending for the past week. Compare it against your budget. Note any unexpected expenses and identify areas where you might adjust spending habits.

Also, briefly review your savings progress. Seeing your savings grow, even incrementally, reinforces positive financial behavior and boosts confidence.

This weekly check-in is not about rigorous accounting; it’s about maintaining awareness of your financial situation. This consistent monitoring empowers you to make informed decisions and fosters a sense of control over your finances.

Use Visualization Techniques for Money Goals

Visualizing your financial goals is a powerful technique to boost financial confidence. It involves creating a vivid mental picture of your desired financial future. This could include imagining yourself comfortably paying off debt, owning a home, or having a substantial savings account.

Regularly engaging in this practice helps to strengthen your commitment to your goals. By mentally rehearsing success, you build motivation and belief in your ability to achieve them. This positive reinforcement reduces feelings of overwhelm and enhances your overall sense of control over your finances.

To effectively use visualization, create a detailed image, including the emotions associated with achieving your goal. For instance, if your goal is to pay off your mortgage, visualize the feeling of freedom and security that comes with being debt-free. The more senses you engage—sight, sound, touch, smell—the more impactful the visualization will be.

Consistency is key. Make visualization a daily practice, even if it’s just for a few minutes. The more frequently you engage in this exercise, the stronger your belief in your ability to achieve your financial goals will become, fostering greater financial confidence.

Create a Safe Space to Talk About Money

Building financial confidence requires open communication. Create a safe space where you can honestly discuss your finances without judgment. This could be with a trusted friend, family member, or a financial advisor.

Choose individuals who are supportive and non-judgmental. Their role is to listen and offer encouragement, not to criticize or offer unsolicited advice.

Establish ground rules for these conversations. This might include agreeing to listen respectfully, avoiding interruptions, and focusing on solutions rather than blame.

Share your goals and concerns openly. This vulnerability is key to building trust and receiving the support you need. Talking about money openly can reduce feelings of isolation and shame.

Remember, a safe space is vital for processing financial anxieties and developing realistic plans to achieve your financial goals.