Effectively managing your finances requires a solid understanding of fixed vs. variable expenses. This article will provide a clear explanation of what constitutes each type of expense, offering practical strategies for budgeting and controlling your spending. Learn how to identify your fixed costs (like rent and loan payments) and variable costs (like groceries and entertainment), empowering you to make informed financial decisions and achieve your financial goals. Understanding this fundamental distinction is crucial for creating a successful budget and building a secure financial future.

What Are Fixed and Variable Expenses?

Understanding the difference between fixed and variable expenses is crucial for effective budgeting. Fixed expenses are costs that remain relatively consistent each month, regardless of your consumption. Examples include rent or mortgage payments, car loans, and insurance premiums.

In contrast, variable expenses fluctuate from month to month depending on your usage or needs. These include groceries, utilities (electricity, water, gas), entertainment, and clothing.

Knowing which expenses fall into each category allows for better financial planning. You can predict your fixed costs with greater accuracy, enabling you to allocate funds more effectively and prioritize paying them. Meanwhile, understanding your variable costs helps identify areas where you can potentially reduce spending to improve your overall financial health.

Examples You Encounter Every Month

Fixed expenses remain consistent each month, regardless of your consumption. Examples include rent or mortgage payments, car loan payments, and insurance premiums. These are typically predictable and budgeted easily.

Variable expenses fluctuate monthly based on your usage or needs. Examples include groceries, utilities (electricity, water, gas), gasoline, entertainment, and dining out. Careful tracking is needed to manage these effectively within your budget.

Understanding the difference between fixed and variable expenses allows for better financial planning. By identifying your spending patterns in both categories, you can create a more realistic and sustainable budget.

Why This Distinction Helps Budget Accuracy

Categorizing expenses as either fixed or variable is crucial for budget accuracy because it allows for more precise forecasting and tracking of spending.

Fixed expenses, such as rent or loan payments, remain relatively constant each month, making them easy to predict and budget for. This predictability forms a stable foundation for your budget.

Conversely, understanding variable expenses, like groceries or entertainment, allows for more realistic budgeting. While harder to pinpoint exactly, tracking these expenses over time reveals spending patterns, facilitating better estimations and informed adjustments to your budget. This improves the overall accuracy of your financial plan.

By differentiating between fixed and variable costs, you gain a clearer understanding of your spending habits and can identify areas for potential savings. This distinction enables a more accurate budget that reflects your actual financial situation and promotes better financial control.

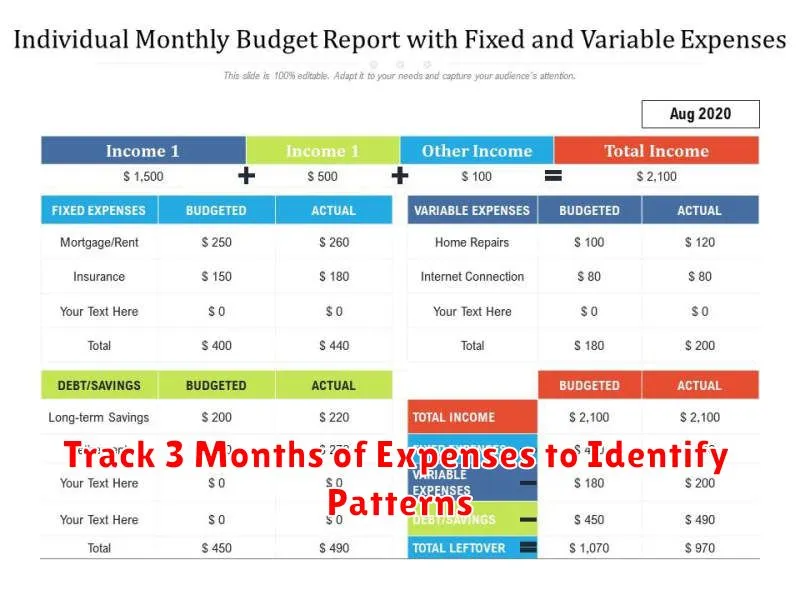

Track 3 Months of Expenses to Identify Patterns

Tracking your expenses for three months provides a comprehensive overview of your spending habits. This period allows you to capture fluctuations in variable expenses, such as groceries and entertainment, and to accurately assess your fixed expenses, like rent or loan payments.

By analyzing three months of data, you can identify recurring patterns and potential areas for savings. For example, you might notice higher spending on dining out during specific months or identify unnecessary subscriptions that can be canceled. This detailed analysis helps you create a more realistic and effective budget.

Categorizing your expenses into fixed and variable types during this tracking period is crucial. This distinction helps you understand where your money is going and allows you to prioritize areas for potential cost reduction while maintaining essential fixed expenses.

Utilizing budgeting apps or spreadsheets can simplify the tracking process. These tools offer features such as automated categorization and expense visualization, making it easier to identify spending trends and make informed financial decisions.

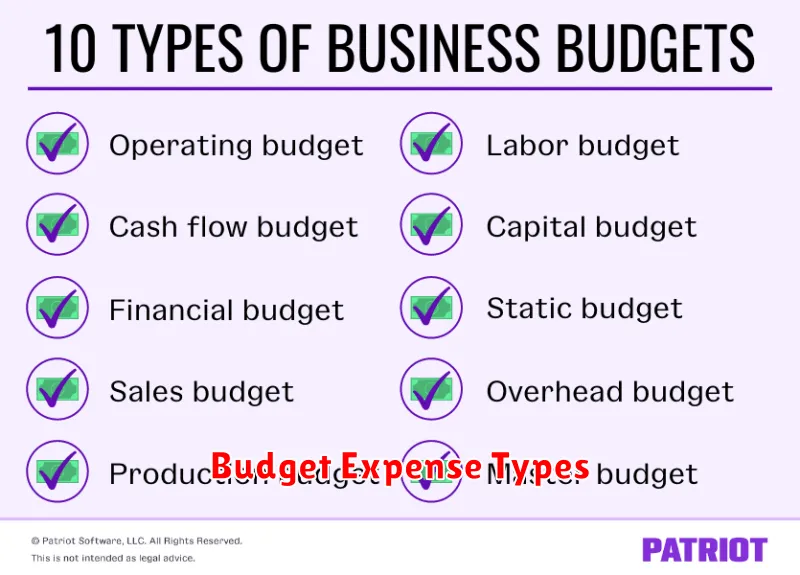

Use Different Budget Buckets for Each Type

Effective budgeting requires differentiating between fixed and variable expenses. This means using separate budget “buckets” for each type.

A fixed expense bucket should include predictable, consistent costs like rent, mortgage payments, loan repayments, and insurance premiums. These amounts generally remain the same each month.

Conversely, a variable expense bucket houses fluctuating costs such as groceries, utilities, entertainment, and clothing. Tracking these separately allows for better monitoring of spending habits and identifying areas for potential savings.

Allocating funds to these distinct buckets provides a clear overview of your financial situation. This approach facilitates informed financial decisions and helps you stay within your budget more effectively.

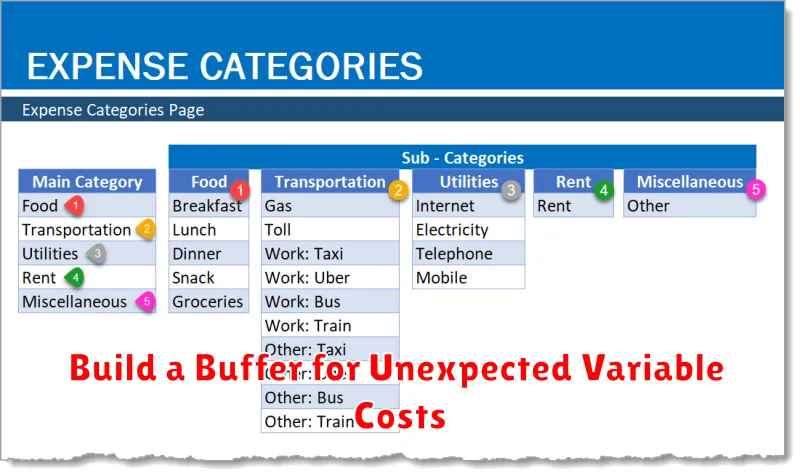

Build a Buffer for Unexpected Variable Costs

Variable costs, unlike fixed costs, fluctuate. This inherent unpredictability makes budgeting challenging. To mitigate this, building a buffer is crucial.

A buffer is a designated amount of money set aside specifically to absorb unexpected increases in variable expenses. This could be anything from higher-than-anticipated grocery bills to unexpected car repairs.

Determining the appropriate buffer size depends on your individual spending habits and risk tolerance. A good starting point is to analyze past variable spending and identify the largest fluctuations. Aim for a buffer that covers at least one or two months’ worth of these unexpected expenses.

Regularly review and adjust your buffer. As your income and spending habits change, so should the size of your buffer. Consistent monitoring ensures it remains an effective safety net.

By establishing a variable cost buffer, you significantly reduce the financial stress associated with unpredictable spending and maintain a more stable budget.

Review Changes as Lifestyle Evolves

Your lifestyle is dynamic, not static. What constitutes a fixed or variable expense today might change significantly over time. Regularly reviewing your budget is crucial.

Marriage, new children, career changes, and major life events dramatically impact your spending habits. These shifts necessitate a reassessment of both your fixed and variable expenses to maintain a healthy financial plan.

For example, a new job may increase your income, allowing you to reclassify some variable expenses as fixed (e.g., upgrading your car payment). Conversely, a reduction in income necessitates a careful review and potential reduction of both fixed and variable costs.

Don’t treat your budget as a set-in-stone document. Regular review (at least annually, preferably quarterly), coupled with the flexibility to adjust your spending plan, ensures your budget remains relevant and effective as your circumstances change.

Adjust Budget Categories Quarterly

Regularly reviewing and adjusting your budget categories is crucial for effective financial management. While fixed expenses (rent, loan payments) remain relatively consistent, variable expenses (groceries, entertainment) fluctuate significantly throughout the year.

A quarterly review allows you to account for these changes. For instance, summer might see increased spending on travel and outdoor activities, while winter may involve higher utility bills. By adjusting your budget categories each quarter, you can accurately track spending, identify areas of overspending, and reallocate funds as needed.

This proactive approach ensures your budget remains relevant and effective, preventing unexpected financial shortfalls and fostering better financial control. Don’t simply set a budget and forget it; adapt it to reflect your actual spending patterns throughout the year.