Have you experienced a recent financial setback, leaving you feeling overwhelmed and unsure of how to recover? Whether it’s due to job loss, unexpected medical expenses, or debt accumulation, this article provides a practical guide on how to reset your finances. Learn proven strategies to rebuild your credit, manage your debt effectively, and create a sustainable financial plan that sets you up for long-term success. Discover how to regain control of your money and achieve your financial goals, even after facing adversity. We’ll cover essential steps to rebuilding your financial future.

Accept and Acknowledge the Financial Setback

The first, crucial step in resetting your finances after a setback is to accept and acknowledge the situation. Avoid denial or minimization. Honestly assess the extent of the financial difficulty. This includes identifying the root cause of the setback, whether it’s job loss, unexpected medical bills, or a significant debt.

Acknowledge your feelings. Financial setbacks often evoke strong emotions like anxiety, anger, and shame. Allowing yourself to feel these emotions, rather than suppressing them, is a vital part of the healing process. This emotional acknowledgment paves the way for a more rational and effective approach to recovery.

Once you’ve fully grasped the severity and causes of your financial setback, you can begin to develop a realistic plan for recovery. This involves gathering all relevant financial documents and creating a clear picture of your current financial standing. This clear-eyed view is fundamental to developing a successful strategy.

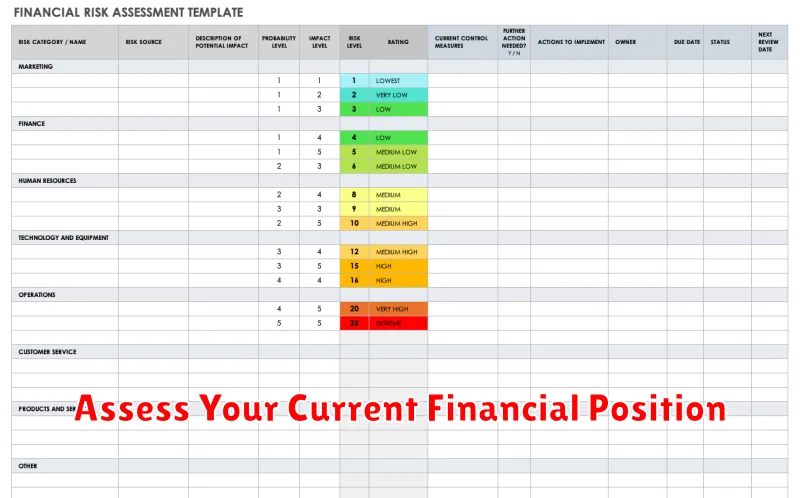

Assess Your Current Financial Position

Before you can reset your finances, you need a clear understanding of your current situation. This involves gathering all relevant financial documents, including bank statements, credit card statements, loan documents, and investment records. Accuracy is crucial at this stage.

Next, create a detailed list of your assets. This includes cash, savings accounts, investments, and the value of any property you own. Simultaneously, compile a comprehensive list of your liabilities, such as outstanding loans, credit card debt, and any other debts you may have.

Calculate your net worth by subtracting your total liabilities from your total assets. This figure provides a snapshot of your current financial health. Understanding your net worth is vital in developing an effective financial recovery plan.

Finally, analyze your monthly income and expenses. Categorize your expenses to identify areas where you can potentially reduce spending. This detailed analysis will reveal your cash flow and highlight areas for improvement in your budget.

Prioritize the Most Urgent Financial Needs

After a financial setback, it’s crucial to prioritize your most urgent needs. This involves creating a tiered system to address your obligations effectively.

The highest priority should be given to essential expenses such as housing (rent or mortgage), utilities, and food. Without these necessities met, further financial recovery becomes significantly more difficult.

Next, focus on avoiding further debt accumulation. This may involve temporarily reducing non-essential spending or negotiating with creditors for payment plans. Minimizing late fees and interest charges is vital to prevent the situation from worsening.

Finally, address existing debt. While not as urgent as immediate necessities, developing a plan to systematically tackle high-interest debt will significantly improve your long-term financial health. Consider strategies like the debt snowball or avalanche method to allocate resources efficiently.

By strategically prioritizing your financial obligations, you can regain control and build a solid foundation for future financial success.

Cut Non-Essential Spending Immediately

Facing a financial setback requires immediate action. One of the most effective steps you can take is to drastically reduce non-essential spending. This means temporarily eliminating expenses that aren’t critical to your basic needs and well-being.

Identify areas where you can make cuts. This might include dining out, entertainment subscriptions (streaming services, gym memberships), new clothing purchases, and non-essential travel. Analyze your bank statements and credit card bills to pinpoint exactly where your money is going. Be honest and thorough in this assessment.

Consider creating a budget that clearly outlines your essential expenses (housing, utilities, food, transportation, debt payments) and allocates a minimal amount to non-essentials, or eliminates them entirely for a specified period. This will give you a clearer picture of where your funds are going and allow you to track your progress.

Remember, this is a temporary measure designed to stabilize your finances. Once you’ve regained control, you can gradually reintroduce some non-essential spending, but only after carefully considering its impact on your overall financial health. Prioritize rebuilding your financial stability before returning to previous spending habits.

Create a 30-Day Recovery Plan

A 30-day recovery plan focuses on immediate actions to stabilize your finances after a setback. The first step is to assess your current financial situation. This includes listing all assets, debts, and monthly income and expenses. Be honest and thorough.

Next, create a realistic budget. Prioritize essential expenses like housing, food, and transportation. Identify areas where you can cut back on non-essential spending, even temporarily. Consider using budgeting apps or spreadsheets for tracking.

Communicate with creditors. If you’re struggling to make payments, reach out to your lenders to explore options like payment plans or hardship programs. Negotiating can prevent further damage to your credit score.

Explore additional income sources. Consider freelance work, part-time jobs, or selling unused items. Every extra dollar contributes to your recovery.

Finally, review your plan daily. Adjust as needed based on your progress and any unexpected expenses. This 30-day period serves as a springboard to a longer-term financial recovery strategy.

Build a Minimalist Budget Temporarily

A temporary minimalist budget is crucial for financial recovery after a setback. Focus on essential expenses: housing, utilities, food, transportation, and debt payments. Temporarily eliminate or drastically reduce non-essential spending such as entertainment, dining out, and subscriptions.

Track your spending meticulously. Use budgeting apps or spreadsheets to monitor where your money goes. This transparency will highlight areas for immediate cost reduction. Identify areas of overspending and create actionable plans to curb them.

Consider reducing your housing costs if possible. This could involve downsizing, finding a cheaper rental, or taking in a roommate. Explore cost-effective transportation options, such as biking, public transit, or carpooling.

Prepare simple, affordable meals at home. Minimize impulse buys by planning your grocery shopping carefully. Look for budget-friendly alternatives for entertainment and leisure activities, such as free community events or borrowing books from the library.

This minimalist approach isn’t forever; it’s a strategic tool to gain financial control. Once your finances stabilize, you can gradually reintroduce some non-essential spending while maintaining a mindful approach to your budget.

Focus on Emotional Recovery as Well

Financial setbacks often trigger strong negative emotions like anxiety, stress, and even depression. Addressing these emotional responses is crucial for a successful financial recovery.

Acknowledge and validate your feelings. Allow yourself time to grieve any losses and process your emotions. Consider seeking support through therapy, support groups, or trusted friends and family. These resources can provide a safe space to process your feelings and develop coping mechanisms.

Practice self-care. Engage in activities that promote emotional well-being, such as exercise, meditation, or spending time in nature. Prioritizing your mental health will enhance your resilience and ability to make sound financial decisions.

Avoid self-blame and negative self-talk. Financial setbacks are often unpredictable and beyond your control. Focus on learning from the experience and developing strategies to prevent future issues, rather than dwelling on past mistakes. Remember that recovery is possible.

By prioritizing emotional recovery alongside financial rebuilding, you set the stage for a more holistic and sustainable path towards financial stability and overall well-being.