Are you struggling to maintain your savings goals despite a steady income? You might be experiencing lifestyle creep, the insidious tendency for spending to increase with income. This article will provide actionable strategies to avoid lifestyle creep and stay on track with your financial goals. Learn how to budget effectively, identify hidden expenses, and cultivate mindful spending habits to protect your hard-earned money and achieve long-term financial security. Discover proven techniques to build wealth and break free from the cycle of lifestyle inflation.

What Is Lifestyle Creep and Why It Happens

Lifestyle creep is the gradual increase in spending as your income rises. It’s the insidious tendency to adjust your lifestyle to match your increased earnings, rather than saving or investing a larger portion of that extra money.

This happens for several reasons. Firstly, it’s easy to become accustomed to a certain standard of living, and as your income grows, it’s tempting to upgrade your spending habits to match. Secondly, cognitive biases play a significant role. We tend to adapt to new circumstances quickly, making higher spending levels feel normal, even essential.

Furthermore, marketing and societal pressures contribute to lifestyle creep. Advertising constantly bombards us with messages suggesting that happiness and success are linked to material possessions. This can lead to a sense of entitlement and a desire to keep up with (or surpass) the lifestyles of others.

Finally, lack of financial planning and budgeting exacerbates the problem. Without a clear plan for how to manage increased income, it’s much easier to let spending rise uncontrollably. A lack of awareness of spending habits also allows lifestyle creep to occur almost invisibly.

Recognize the Signs of Income-Driven Spending

Income-driven spending, a hallmark of lifestyle creep, occurs when your spending automatically increases with every pay raise or bonus. It’s a subtle shift, easily missed, but detrimental to long-term savings.

Key signs include: upgrading your car or phone immediately after a raise; regularly exceeding your previously established monthly budget; justifying increased spending with the rationale “I deserve it” or “I can afford it now”; feeling a constant need to keep up with the Joneses; and a noticeable decrease in savings despite increased income.

Another warning sign is a growing reliance on credit cards to fund lifestyle enhancements, indicating a potential inability to manage increased expenses.

Recognizing these patterns is crucial. It allows you to consciously choose between saving more and maintaining a comfortable lifestyle, rather than falling prey to the automatic escalation of spending.

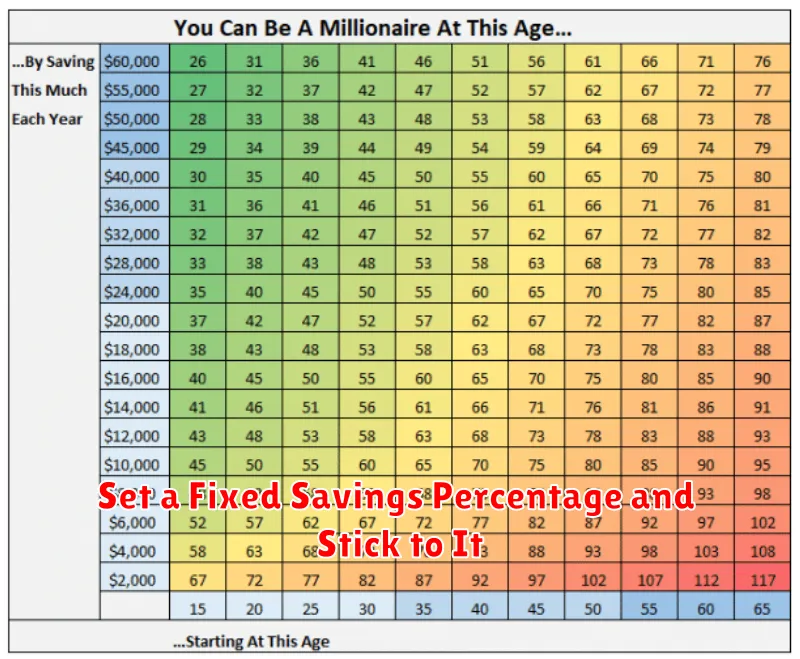

Set a Fixed Savings Percentage and Stick to It

One of the most effective strategies to combat lifestyle creep and maintain consistent savings is to establish a fixed savings percentage and diligently adhere to it. Instead of aiming for a specific savings amount each month, which can be easily derailed by fluctuating income or unexpected expenses, focus on a percentage of your income.

Determine a percentage that aligns with your financial goals and risk tolerance. Start with a manageable percentage, even if it’s small (e.g., 5-10%), and gradually increase it as your income grows. This approach ensures that your savings grow proportionally with your earnings, preventing you from consuming all extra income as your lifestyle expands.

To maintain consistency, automate your savings. Set up automatic transfers from your checking account to your savings account on a regular schedule (e.g., weekly or bi-weekly). This removes the temptation to spend the money and ensures that your savings are prioritized.

Regularly review and adjust your savings percentage as needed. Life circumstances change, and your savings goals may evolve. Periodically assess your progress and make adjustments to your savings percentage to stay on track with your long-term financial objectives.

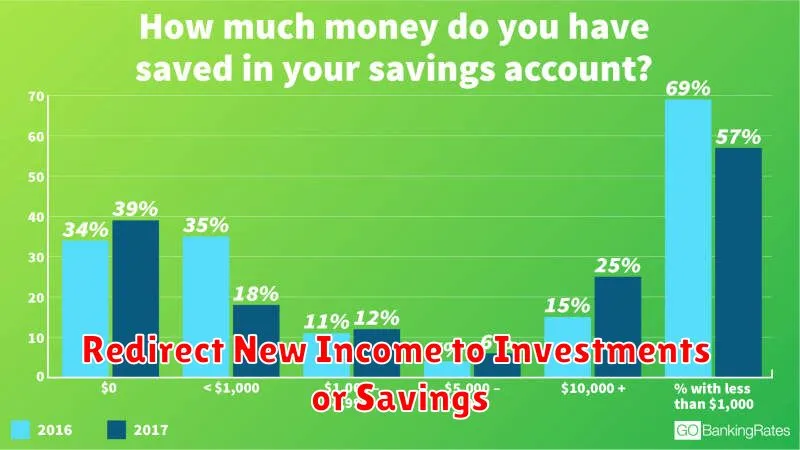

Redirect New Income to Investments or Savings

A crucial step in avoiding lifestyle creep is to proactively manage any increase in income. Instead of immediately raising your spending to match your new earnings, redirect the additional funds towards your savings and investment goals. This ensures continued progress toward your financial objectives.

This strategy helps maintain a consistent savings rate even as your income grows. By automatically allocating a portion of any raise or bonus to investments, you effectively build wealth and avoid the trap of gradually increasing your expenses to match a higher income level.

Consider establishing automatic transfers to your savings or investment accounts. This automated approach removes the temptation to spend the extra money and makes saving a seamless part of your financial routine. This proactive approach is key to long-term financial success.

Prioritize your financial goals. Determine whether you’ll focus on paying down debt, building an emergency fund, or contributing to retirement accounts. Allocate your new income strategically to align with these priorities. This focused approach prevents aimless spending and accelerates progress toward your goals.

Create a Budget That Prioritizes Values

To combat lifestyle creep and maintain savings, a budget reflecting your values is crucial. Instead of simply tracking expenses, prioritize spending aligned with what truly matters to you. This might involve allocating more funds towards experiences like travel or personal growth like education, while consciously reducing spending in areas less aligned with your values.

Start by identifying your core values. Are they family, health, education, or perhaps environmental sustainability? Once identified, categorize your spending based on these values. This allows for a more intentional allocation of resources, preventing frivolous spending that contributes to lifestyle creep. You may discover that shifting funds from less valuable expenditures towards those aligned with your priorities leads to increased satisfaction and maintained savings.

Regularly review your budget and spending habits. Flexibility is key; your values may evolve, requiring adjustments to your budget. This ongoing assessment ensures your financial plan remains in sync with your life goals and prevents unwanted lifestyle inflation.

By creating a budget that prioritizes your values, you gain control over your finances and prevent lifestyle creep from hindering your long-term savings goals. This method fosters a more mindful and fulfilling approach to money management.

Delay Major Upgrades by 6 Months

Lifestyle creep often manifests as impulsive upgrades. A six-month delay on significant purchases—new appliances, a car, home renovations—provides crucial time for reflection. This delay allows you to determine if the purchase is a genuine need or a want fueled by lifestyle inflation.

During this period, re-evaluate your budget and consider alternatives. Perhaps a repair is sufficient instead of a full replacement. This mindful approach helps maintain financial stability and prevents unnecessary spending, thus supporting your long-term savings goals.

The extended timeframe also facilitates thorough research. Compare prices, read reviews, and explore more affordable options. This will ensure you make a well-informed decision, maximizing your investment and minimizing buyer’s remorse.

By implementing this strategy, you gain better control over your finances and avoid the common pitfall of lifestyle creep. This proactive approach fosters disciplined spending habits and contributes to significant long-term savings.

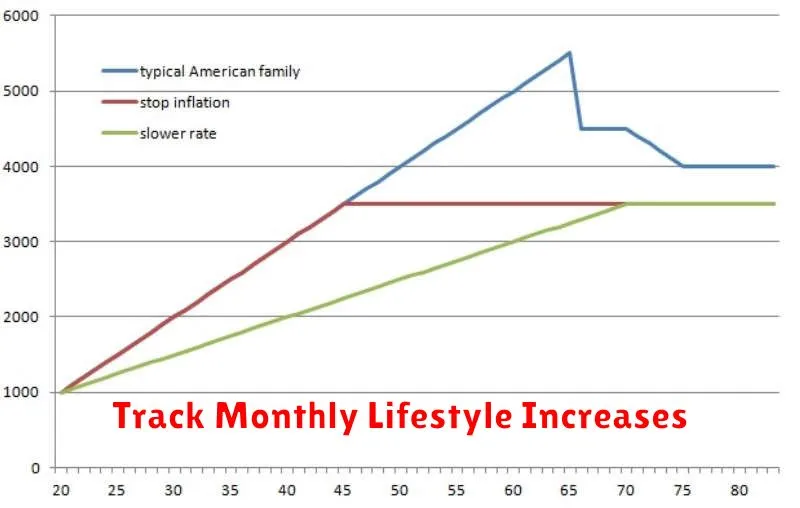

Track Monthly Lifestyle Increases

To effectively combat lifestyle creep, meticulous tracking of your monthly expenses is crucial. Regular monitoring allows you to identify gradual increases in spending that might otherwise go unnoticed. This involves more than simply reviewing your bank statements; it requires categorizing expenses to pinpoint areas of unnecessary spending growth.

Consider using budgeting apps or spreadsheets to track spending patterns across various categories such as dining out, entertainment, and subscriptions. By comparing monthly expenses, you can quickly spot any significant deviations from your budget and address them proactively. This early detection is vital to prevent small increases from accumulating into substantial budget overruns.

Detailed record-keeping is key to success. Note not only the amount spent but also the reason for the purchase. This added level of detail will provide valuable insights into your spending habits and facilitate informed decisions about adjusting your budget to maintain your savings goals.

Celebrate Growth Without Overspending

Achieving financial goals often involves periods of growth – promotions, raises, or successful business ventures. It’s crucial to celebrate these milestones, but avoiding lifestyle creep is key to maintaining your savings momentum.

Instead of immediately upgrading your lifestyle to match your increased income, consider allocating a portion of the extra funds towards your long-term savings goals. This might involve increasing contributions to retirement accounts, paying down high-interest debt, or investing in your future.

Mindful spending is paramount. Identify areas where you can make small, sustainable changes without sacrificing enjoyment. This could include preparing more meals at home, exploring free or low-cost entertainment options, or utilizing coupons and discounts.

Remember that true celebration lies in financial security and achieving your long-term objectives. While acknowledging growth is important, a balanced approach that prioritizes saving over instant gratification will significantly contribute to your overall financial well-being.