Are you tired of struggling with your finances? Do you dream of a life where you’re not constantly worried about money? Creating a monthly budget that actually works can seem daunting, but it’s the key to achieving financial freedom. This comprehensive guide will walk you through the steps to build a practical and effective budget, helping you take control of your spending, save for your goals, and finally achieve financial peace of mind. Learn how to track your expenses, allocate funds effectively, and create a budget that fits your unique lifestyle. Discover the secrets to budgeting success and start building a brighter financial future today.

Calculate Your Total Monthly Income

Accurately calculating your total monthly income is the first crucial step in creating a workable budget. This involves adding up all sources of regular income you receive.

Include all forms of income, such as your salary or wages from your primary job, any income from a secondary job or freelance work, rental income, investment income (dividends, interest), Social Security benefits, or alimony or child support payments.

Be sure to use your net income (income after taxes and deductions) rather than your gross income (income before taxes and deductions) for the most accurate budget. This will give you a clearer picture of the money you actually have available to spend each month.

Keep a record of your income for a few months to ensure you capture all sources and any fluctuations. This will provide a more realistic average monthly income for your budget.

List All Fixed and Variable Expenses

Creating a realistic budget requires a thorough understanding of your expenses. Categorizing them into fixed and variable costs is crucial.

Fixed expenses are predictable and consistent, occurring regularly with little fluctuation. Examples include rent or mortgage payments, car loans, insurance premiums (health, auto, home), and subscription services. These are generally easier to track as the amount due remains relatively constant.

Variable expenses, on the other hand, fluctuate from month to month. These include groceries, utilities (electricity, gas, water), gasoline, entertainment, clothing, and dining out. Tracking these requires more diligent monitoring, perhaps through receipts or online banking statements.

To effectively list your expenses, use a spreadsheet or budgeting app. Carefully review your bank and credit card statements for the past few months to accurately reflect your spending habits. Be thorough and honest with yourself – accurately recording every expense, big or small, is key to creating a workable budget.

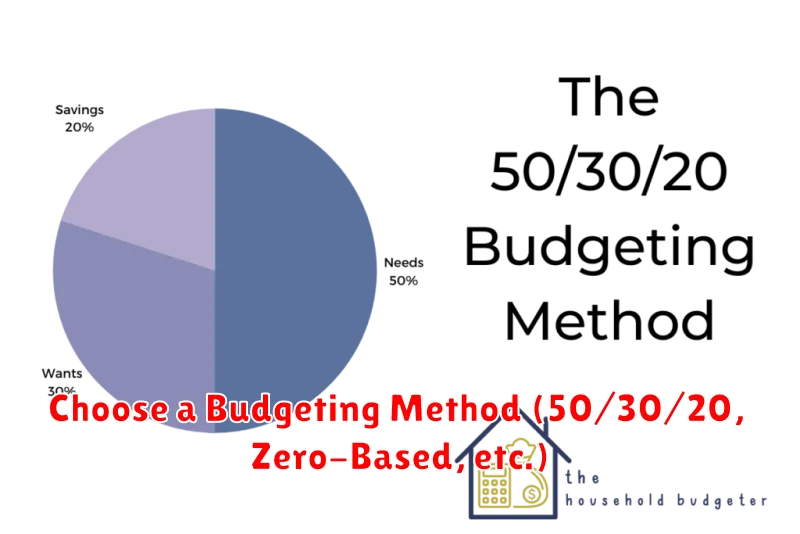

Choose a Budgeting Method (50/30/20, Zero-Based, etc.)

Selecting a budgeting method is crucial for effective financial management. Several popular methods cater to different needs and preferences. The 50/30/20 rule allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This simplicity makes it beginner-friendly. Alternatively, the zero-based budget method assigns every dollar a specific purpose, ensuring all income is accounted for. This approach offers greater control but requires more detailed tracking. Envelope budgeting involves allocating cash to different categories in physical envelopes. This tactile approach can enhance awareness of spending habits. Finally, the 50/20/30 rule is a variation which prioritizes a larger savings allocation.

Consider your financial goals and personality when choosing. If you prefer simplicity, the 50/30/20 method is ideal. For meticulous control, the zero-based budget is more suitable. Envelope budgeting is effective for visual learners and those who struggle with impulse spending. Ultimately, the best method is one you’ll consistently adhere to.

Use a Budgeting App or Spreadsheet

Managing your finances effectively requires a reliable system for tracking income and expenses. A budgeting app or spreadsheet provides this crucial structure. Apps offer user-friendly interfaces with features like automated transaction categorization and visual representations of spending habits. Spreadsheets, while requiring more manual input, provide greater customization and control.

Choosing the right tool depends on personal preference and tech-savviness. Consider factors like ease of use, features offered (e.g., goal setting, bill reminders), and integration with your bank accounts. Both methods allow for detailed expense tracking, facilitating informed financial decisions.

Consistency is key regardless of your chosen method. Regularly update your budget with income and expenses. Reviewing your budget periodically allows you to identify areas for improvement and adjust your spending as needed.

Set Clear Financial Priorities for the Month

Before diving into the specifics of your monthly budget, it’s crucial to establish clear financial priorities. This involves identifying your most important financial goals for the month. Are you focusing on paying down high-interest debt? Saving for a down payment on a house? Building your emergency fund? Defining these priorities allows you to allocate your funds strategically and ensures you’re making progress toward your larger financial objectives.

Prioritization is key to effective budgeting. Consider using a method like the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment) as a guideline, but adjust it to reflect your individual priorities. For example, if paying off debt is paramount, you might allocate a larger percentage to debt repayment, even if it means temporarily reducing spending on wants.

Write down your priorities. Making them visible helps reinforce your commitment and provides a reference point as you create your budget. Remember, your financial priorities may shift from month to month, so revisit and adjust them regularly to stay on track.

Adjust Categories Based on Real-Life Changes

Your budget isn’t set in stone. Life throws curveballs, and your financial plan should be flexible enough to handle them. Regularly review your spending categories to reflect your evolving circumstances.

For example, if you’ve recently started a new job with a longer commute, you might need to increase your transportation category. Conversely, if you’ve paid off a significant debt, you can allocate those funds elsewhere, perhaps to savings or investments.

Seasonal changes also impact spending. You might need a larger clothing budget in the fall and winter, or a higher entertainment budget during the summer months. Adjust accordingly to avoid overspending.

Unexpected expenses, like car repairs or medical bills, require immediate budget adjustments. Consider creating a contingency fund to cushion against such unforeseen events. This allows for flexibility without derailing your overall financial goals.

By proactively adjusting your budget categories to match real-life changes, you maintain a realistic and effective financial plan that adapts to your needs, preventing overspending and promoting long-term financial health. Flexibility is key to a successful budget.

Track Spending Weekly to Stay on Track

Tracking your spending weekly is crucial for a successful monthly budget. It allows for early detection of overspending and provides the opportunity to make timely adjustments.

Instead of waiting until the end of the month to review your finances, a weekly check-in offers a real-time perspective on your spending habits. This proactive approach helps you stay aware of where your money is going and identify areas for potential savings.

Using a simple spreadsheet, budgeting app, or even a notebook, record your expenses as you incur them. Categorizing your spending (e.g., groceries, transportation, entertainment) will further enhance your understanding of your financial behavior.

This weekly review allows for course correction. If you notice you’re exceeding your budget in a specific category, you can consciously reduce spending in that area during the following week. This proactive management significantly increases the likelihood of achieving your monthly financial goals.

Reflect and Revise Your Budget Monthly

Creating a budget is only half the battle; regular review and adjustment are crucial for long-term success. At the end of each month, take time to compare your planned spending versus your actual spending.

Analyze variances. Did you overspend in any categories? Were there unexpected expenses? Understanding these deviations helps you identify areas needing improvement.

Adjust your budget accordingly. Based on your analysis, make necessary changes to your spending plan for the following month. This might involve cutting back in certain areas or increasing savings contributions.

Don’t be afraid to revise. Your budget is a living document. Your circumstances and financial goals may change, requiring adjustments to your budget. Regular revisions ensure it remains relevant and effective.

Track your progress. Continue monitoring your spending throughout the month to ensure you stay on track with your revised budget. This iterative process of reflection, revision, and tracking is key to building a sustainable and effective financial plan.