Are you ready to transform your financial future? Tracking your spending daily isn’t just about knowing where your money goes; it’s about gaining complete control over your finances. This article will reveal how daily spending tracking can change everything, from eliminating unnecessary expenses and building a robust savings plan, to achieving your long-term financial goals and ultimately, achieving true financial freedom. Discover the transformative power of daily financial awareness and unlock your path to a more secure and prosperous future.

Understand Where Your Money Really Goes

Daily spending tracking offers unparalleled clarity into your financial habits. Instead of relying on hazy estimations, you gain a precise picture of where your money is actually spent. This detailed view reveals surprising patterns, highlighting areas where you may be overspending unintentionally.

By meticulously recording every transaction – from your morning coffee to larger purchases – you uncover hidden spending leaks. These are the small, often overlooked expenses that accumulate over time, significantly impacting your overall budget. This level of detail is crucial for effective budget management.

Understanding your spending patterns enables you to make informed financial decisions. You can prioritize essential expenses, identify areas for potential savings, and allocate your resources more efficiently. This granular awareness allows you to take control of your finances and work towards your financial goals with increased confidence.

Ultimately, understanding where your money goes is the foundation of responsible financial management. Daily tracking empowers you to identify areas for improvement and make conscious choices about your spending, leading to better financial health.

Log Every Expense—No Matter How Small

Tracking every expense, regardless of size, is crucial for effective budgeting. Small purchases often accumulate unnoticed, leading to significant discrepancies between expected and actual spending. By meticulously logging even seemingly insignificant items like a cup of coffee or a candy bar, you gain a comprehensive picture of your spending habits.

This detailed record allows for precise identification of areas where unnecessary spending occurs. It helps reveal hidden expenses and highlights potential areas for savings. The habit of daily logging fosters greater financial awareness, encouraging more mindful spending decisions.

Furthermore, detailed expense tracking simplifies the process of budgeting and financial planning. Accurate data allows for realistic budget allocation and facilitates informed financial decisions. The comprehensive record serves as a valuable tool for monitoring progress toward financial goals.

In essence, the seemingly insignificant act of logging every expense provides significant insights into your financial health and empowers you to make better, more informed choices about your money.

Use Apps That Make It Easy and Quick

Manually tracking spending is time-consuming and prone to errors. Budgeting apps streamline the process significantly. Many offer features like automatic transaction imports from bank accounts and credit cards, eliminating the need for manual entry. This saves you valuable time and ensures accuracy.

These apps also provide visual representations of your spending habits, making it easier to identify areas where you might be overspending. Categorization features allow for quick analysis of spending across different categories, such as groceries, entertainment, or transportation. This level of detail offers valuable insights into your financial behavior.

Furthermore, many apps offer goal-setting tools to help you stay on track with your financial aspirations, whether it’s saving for a down payment or paying off debt. The convenience and efficiency offered by these apps make daily spending tracking far more manageable and effective.

Review Patterns Weekly for Insights

Daily spending tracking provides granular data, but reviewing that data weekly offers crucial insights you might miss in the daily grind. Weekly reviews allow you to identify spending patterns and trends that emerge over time.

For example, you might notice a consistent uptick in spending on eating out on Wednesdays, or a recurring surge in online shopping on weekends. These patterns, invisible in daily snapshots, become readily apparent with a weekly overview. This allows for targeted adjustments to your budget and spending habits.

Analyzing weekly summaries lets you assess the effectiveness of your budget and spending strategies. You can quickly see if your efforts are paying off or if further changes are needed. This iterative process, combining daily tracking with weekly analysis, is critical for achieving long-term financial success.

Spot Triggers and Adjust Budget Accordingly

Daily spending tracking reveals spending triggers – situations or emotions prompting unplanned purchases. Identifying these is crucial for effective budgeting.

Once you’ve pinpointed your triggers (e.g., stress-eating, boredom shopping, social pressure), you can proactively adjust your budget. This might involve setting aside a small, pre-allocated amount for these situations to satisfy the urge without exceeding your budget.

Adjustments can include: reducing allocations in other areas to compensate, implementing stricter spending limits in high-trigger categories, or exploring alternative, less expensive ways to address the underlying need (e.g., finding free activities instead of shopping).

By actively monitoring spending and reacting to identified triggers, you gain greater control over your finances and prevent overspending. This proactive approach ensures your budget remains functional and aligns with your financial goals.

Turn Tracking into a Daily Ritual

Transforming spending tracking from a sporadic task into a daily ritual is crucial for maximizing its effectiveness. Consistency is key; daily tracking ensures you remain acutely aware of your spending habits, preventing overspending and fostering better financial control.

Integrate tracking into your existing routines. Perhaps you review transactions after your morning coffee or before bed. Finding a convenient time ensures adherence. The goal is to make it automatic, similar to brushing your teeth—a non-negotiable part of your day.

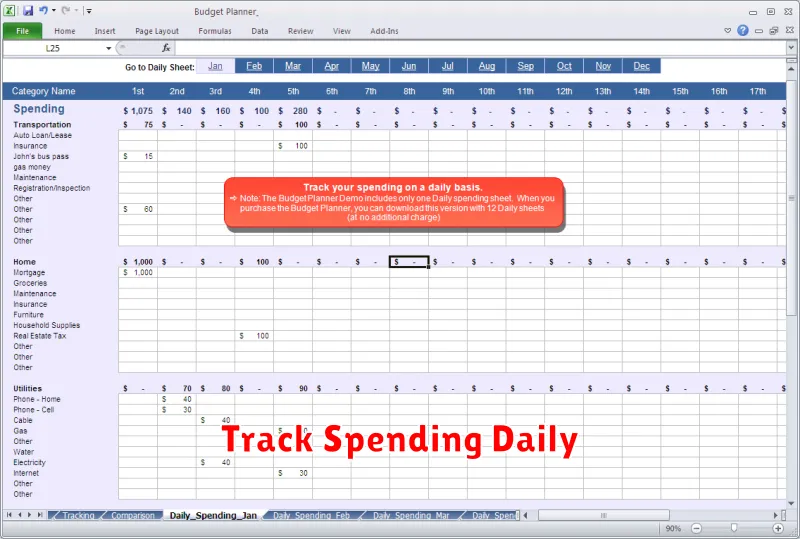

Employ tools that simplify the process. Utilize user-friendly budgeting apps or a simple spreadsheet. The easier it is to track, the more likely you’ll maintain the daily habit. Choose a method that aligns with your technological proficiency and personal preferences.

Celebrate small wins. Acknowledge your consistent effort; this positive reinforcement strengthens the habit. Reviewing your progress, even on days when spending is higher than anticipated, provides valuable insights and maintains motivation.

Persistence is paramount. There will be days when tracking feels tedious or challenging. Don’t let these occasional setbacks derail your progress. View each day as an opportunity to reinforce the habit and solidify your commitment to financial awareness.

Celebrate Awareness as a Form of Growth

Daily spending tracking isn’t merely about restricting finances; it’s about fostering self-awareness. The act of meticulously recording every expense forces a confrontation with spending habits, revealing patterns and areas for improvement that were previously obscured.

This increased awareness is a significant step towards financial growth. Recognizing impulsive buys or unnecessary subscriptions allows for conscious choices, ultimately leading to better budget management and increased savings. It’s a journey of self-discovery, where each recorded transaction becomes a data point contributing to a more informed and responsible financial future.

Celebrating this newfound awareness is crucial. Acknowledge the effort, appreciate the insights gained, and recognize the positive change in your financial behavior. This celebratory approach reinforces the positive habits you are cultivating, ensuring consistent progress and lasting impact.

Therefore, the daily act of tracking spending should not be viewed as a chore, but as a powerful tool for personal development and a testament to your commitment to financial well-being. The process itself, with its accompanying self-awareness and celebration of progress, marks significant growth.