Understanding the role of emotional spending in personal finance is crucial for achieving financial wellness. Many individuals struggle with impulse purchases driven by emotions like stress, sadness, or even excitement, leading to overspending and debt. This article will explore the complex relationship between emotions and financial decisions, providing insights into how to identify emotional spending triggers, develop effective coping mechanisms, and ultimately regain control over your finances.

What Is Emotional Spending and How to Spot It

Emotional spending refers to purchasing items not out of need or reasoned desire, but as a response to emotions such as stress, sadness, boredom, or anxiety. It’s a coping mechanism, often unconscious, where spending provides a temporary feeling of relief or pleasure.

Spotting emotional spending requires self-awareness. Key indicators include: buying things you don’t need; feeling guilty or ashamed after a purchase; spending impulsively, without planning; using shopping as a distraction from negative feelings; and noticing a correlation between stressful events and increased spending. Tracking your spending habits through budgeting apps or a journal can help identify patterns of emotional spending.

Unlike planned purchases, emotional spending often involves low-value, non-essential items bought on impulse. It contrasts with rational spending, where purchases are deliberate and aligned with financial goals. Recognizing the triggers and developing healthier coping mechanisms are crucial for managing emotional spending and achieving financial well-being.

Common Triggers Behind Overspending

Emotional spending, driven by underlying feelings rather than rational needs, is a significant factor in personal finance challenges. Several common triggers fuel this behavior.

Stress and anxiety are major culprits. When faced with overwhelming emotions, individuals often seek solace in retail therapy, a temporary escape that can lead to long-term financial strain.

Boredom and loneliness can also contribute to overspending. Shopping becomes a means of filling time and combating feelings of isolation, often resulting in impulsive purchases.

Low self-esteem frequently manifests as overspending. Individuals might buy luxury items or excessive quantities of goods to compensate for feelings of inadequacy or boost their self-image.

Social pressure plays a role as well. The desire to keep up with peers or meet societal expectations can drive individuals to make purchases they cannot truly afford, leading to financial difficulties.

Celebrations and rewards can easily turn into overspending opportunities. While celebrating is important, it’s crucial to set a budget and stick to it to prevent impulsive extravagance.

Understanding these common triggers is the first step towards managing emotional spending and achieving better financial well-being.

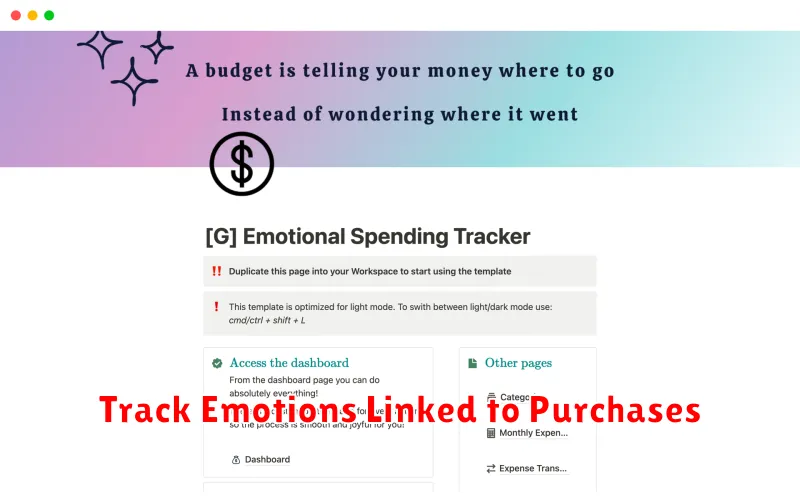

Track Emotions Linked to Purchases

Understanding the emotional drivers behind your spending is crucial for improving your financial health. Tracking your emotions alongside your purchases offers valuable insights.

Create a simple journal or spreadsheet. After each purchase, note not only the item and cost, but also how you felt before, during, and after the purchase. Were you feeling stressed, sad, happy, bored, or something else? Identifying these emotional triggers is key.

Over time, you’ll begin to see patterns emerge. You might discover you tend to overspend when feeling stressed or lonely. This awareness allows you to develop coping mechanisms that don’t involve excessive spending. Consider alternative stress-relieving activities like exercise or spending time with loved ones.

By consciously connecting your emotions to your spending, you gain control over your finances. This self-awareness empowers you to make more informed and rational purchasing decisions, ultimately leading to improved financial well-being.

Create Healthy Alternatives to Shopping for Relief

Shopping can be a tempting way to cope with stress, boredom, or sadness, but it often leads to financial difficulties. To break this cycle, it’s crucial to develop healthy alternatives for emotional regulation.

Exercise is a powerful stress reliever. Physical activity releases endorphins, improving mood and reducing anxiety. Even a short walk can make a difference.

Mindfulness and meditation techniques can help you become more aware of your emotions and manage them effectively. Practicing mindfulness allows you to observe your feelings without judgment, reducing impulsive spending.

Creative outlets, such as painting, writing, or playing music, provide healthy ways to express emotions and channel energy. Engaging in hobbies can be incredibly therapeutic.

Connecting with loved ones provides emotional support and reduces feelings of isolation. Spending quality time with friends and family can offer comfort and perspective.

Journaling can help you identify triggers for emotional spending and develop coping strategies. Reflecting on your feelings and identifying patterns can lead to positive changes.

By actively cultivating these healthy alternatives, you can gradually reduce reliance on shopping as a coping mechanism and achieve better financial health.

Use a Purchase Pause Technique (24-Hour Rule)

Emotional spending, driven by impulses rather than needs, often leads to financial regret. A simple yet effective strategy to combat this is the 24-hour rule, also known as a purchase pause.

This technique involves delaying non-essential purchases for at least 24 hours. Before making a purchase, write down the item, its price, and your reasoning behind wanting it. After 24 hours, re-evaluate your desire. Often, the initial urge subsides, revealing whether the purchase is truly necessary or simply an emotional impulse.

The 24-hour rule provides valuable time for reflection, allowing you to assess the purchase rationally and avoid impulsive spending. This simple technique can significantly impact your financial health by reducing unnecessary expenses and promoting mindful spending habits.

Review and Reflect on Spending Patterns Monthly

Regularly reviewing your spending patterns is crucial for managing personal finances, especially when addressing emotional spending. A monthly review allows you to identify trends and patterns in your spending habits. This process involves carefully examining your bank statements, credit card bills, and any other financial records.

Pay close attention to where your money is going. Categorize your expenses (e.g., necessities, entertainment, impulsive buys) to gain a clearer picture. This categorization will highlight areas where you may be overspending, particularly on non-essential items.

The next step is reflection. Ask yourself why you made certain purchases. Were they driven by genuine need, or were emotions like stress, boredom, or sadness influencing your decisions? Identifying the emotional triggers behind your spending can help you develop strategies to manage them.

By consistently reviewing and reflecting on your monthly spending, you can gain valuable insights into your financial behavior. This awareness empowers you to make informed decisions, set realistic budgets, and develop healthier spending habits to ultimately reduce the impact of emotional spending on your personal finances.

Replace Emotional Habits with Productive Actions

Emotional spending, driven by feelings rather than logic, significantly impacts personal finances. To regain control, replacing impulsive emotional habits with productive actions is crucial.

Identify your triggers: Understand what emotions—stress, boredom, sadness—lead to unnecessary spending. Keeping a spending journal can help pinpoint these patterns.

Develop healthy coping mechanisms: Instead of shopping, explore alternative stress relievers like exercise, meditation, or spending time with loved ones. These activities offer emotional benefits without financial repercussions.

Set realistic financial goals: Creating clear, achievable goals—like saving for a down payment or paying off debt—provides motivation and focus, shifting your attention away from impulsive purchases.

Practice mindful spending: Before making a purchase, pause to evaluate its necessity and long-term value. This conscious decision-making process reduces the likelihood of emotional spending.

Seek professional help: If emotional spending is overwhelming, consider seeking guidance from a financial advisor or therapist. They can offer personalized strategies and support to overcome this habit.

By consciously replacing emotional spending habits with productive actions, you can build a healthier relationship with money and achieve your financial objectives.

Seek Support if Spending Is Linked to Deeper Issues

Emotional spending, while sometimes a harmless indulgence, can become a serious problem if it’s masking underlying emotional distress. If your spending habits are consistently leading to financial strain and you find yourself using purchases to cope with stress, anxiety, loneliness, or depression, it’s crucial to seek professional help.

A therapist or counselor can provide tools and strategies to manage these underlying emotions in healthier ways. They can help you identify the triggers for your emotional spending and develop coping mechanisms that don’t involve excessive purchasing. Ignoring these deeper issues will likely result in a vicious cycle of financial hardship and emotional turmoil.

Seeking support doesn’t mean weakness; it’s a sign of strength and a proactive step towards building a healthier relationship with your finances and your well-being. Financial counselors can also assist with developing a budget and managing debt, providing a comprehensive approach to recovery.