Setting monthly financial intentions that actually stick can transform your relationship with money. This article provides a practical guide to help you establish achievable financial goals, develop effective budgeting strategies, and cultivate consistent saving habits. Learn how to create a personalized financial plan, overcome common obstacles, and track your progress to ensure you stay on track and achieve your long-term financial objectives. Discover the secrets to building a stronger financial future through intentional money management.

Difference Between Goals and Intentions

While often used interchangeably, goals and intentions hold distinct meanings in the context of financial planning. A goal is a specific, measurable, achievable, relevant, and time-bound (SMART) objective. It’s the destination you aim to reach, like “saving $1,000 by December.”

An intention, conversely, represents your underlying motivation and commitment to achieving that goal. It’s the driving force behind your actions. For example, your intention might be “to prioritize saving to reduce financial stress” or “to build a strong emergency fund.” Intentions provide the emotional and psychological foundation upon which you build and sustain the pursuit of your goals. Without strong intentions, goals can feel arbitrary and easily abandoned.

Therefore, effective financial planning involves setting clear, SMART goals while also cultivating powerful, meaningful intentions that fuel your consistent effort towards achieving them.

Choose One Theme for the Month (e.g., Save, Simplify)

Instead of tackling numerous financial goals simultaneously, focus on a single, achievable theme each month. This prevents overwhelm and allows for concentrated effort. Examples include saving (building an emergency fund, contributing to retirement), simplifying (reducing spending, paying down debt), or investing (researching investment options, making a specific investment). Choosing one theme ensures you dedicate your energy effectively, boosting your chances of success and avoiding burnout.

Selecting a relevant theme depends on your current financial situation and priorities. If you’re struggling with debt, “simplify” might be the best choice. If your emergency fund is lacking, focus on “saving.” Prioritize the area needing the most attention. This focused approach provides a sense of accomplishment and motivates you to continue your financial journey.

Remember to make your chosen theme SMART (Specific, Measurable, Achievable, Relevant, Time-bound). Instead of vaguely aiming to “save more,” set a specific target, like “save $500 this month for emergency expenses.” This clarity enhances accountability and tracking progress.

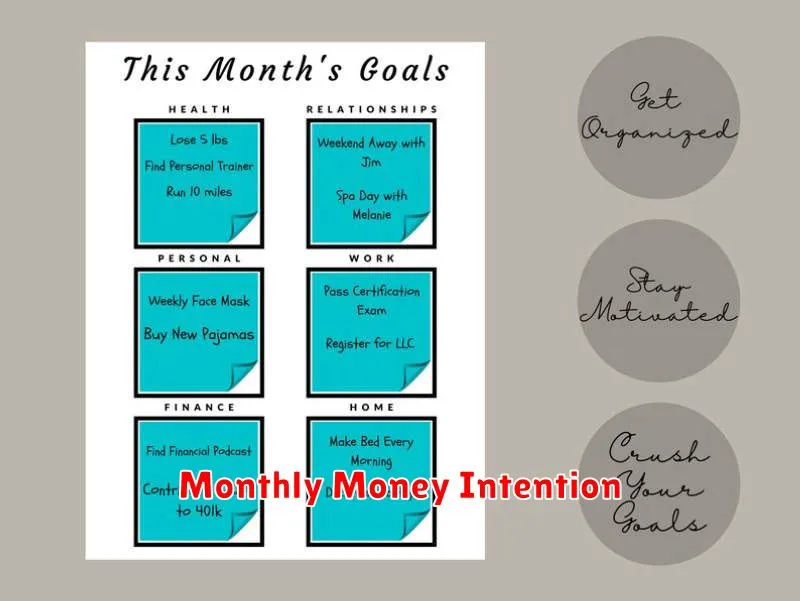

Create a Visual Reminder of Your Intention

A visual reminder significantly boosts your chances of sticking to your monthly financial intentions. Consider creating a simple, yet impactful, visual representation of your goals.

Options include a whiteboard with your key financial targets written clearly, a digital wallpaper for your phone or computer showcasing your goal amount or a physical vision board with images representing financial freedom and success.

The key is to make it easily accessible and visible. This constant visual reminder will keep your intentions at the forefront of your mind, encouraging consistent progress towards your objectives.

Regularly review and update your visual reminder as your monthly financial situation evolves and your goals adapt.

Write a One-Sentence Intention and Post It

To solidify your monthly financial goals, craft a concise, action-oriented sentence reflecting your primary financial intention for the month and prominently display it where you’ll see it daily, serving as a consistent reminder and motivator.

Track Alignment Between Actions and Intention

Regularly check if your financial actions align with your monthly intentions. This involves reviewing your spending against your budget, ensuring investments are on track, and confirming you’re making progress towards your savings goals.

Use a simple tracking method, such as a spreadsheet or budgeting app, to monitor your income and expenses. Compare your actual spending with your planned spending to identify any discrepancies. This will highlight areas where you might need to adjust your behavior or refine your intentions.

Honest self-reflection is crucial. If your actions consistently deviate from your intentions, analyze the reasons. Are your intentions unrealistic? Do you need to improve your budgeting skills or seek professional financial advice? Adjusting your approach ensures your actions support your financial goals.

Reflect Weekly on Challenges and Wins

Regular reflection is crucial for maintaining momentum with your financial intentions. Dedicate time each week to review your progress. Identify challenges encountered, such as unexpected expenses or impulsive spending. Analyze the root causes to prevent recurrence.

Simultaneously, acknowledge and celebrate your wins, no matter how small. Did you successfully stick to your budget this week? Did you make an extra payment towards a debt? Recognizing these achievements reinforces positive behavior and keeps you motivated.

This weekly review process helps you stay accountable and adjust your approach as needed. It fosters a mindset of continuous improvement, ultimately increasing your chances of achieving your monthly financial goals.

Set a Reset Ritual for the Next Month

Creating a monthly reset ritual is crucial for maintaining financial momentum. This involves dedicating time at the end of each month to review your progress against your financial intentions.

Begin by tracking your spending. Analyze where your money went and identify areas for improvement. This self-reflection is key to understanding your spending habits.

Next, evaluate your progress toward your monthly financial goals. Did you meet your savings target? Did you stick to your budget? Celebrate successes and learn from any shortfalls.

Finally, plan for the next month. Adjust your budget based on your previous month’s performance and set new, realistic goals. This iterative process helps you refine your financial approach and stay on track.

By establishing this consistent reset ritual, you’ll build a stronger foundation for achieving your long-term financial objectives.