Are you struggling to manage your personal finances? Feeling overwhelmed by bills, savings goals, and investments? This comprehensive guide on how to organize your personal finances digitally will equip you with the tools and strategies to take control of your financial future. Learn how to budget effectively, track your spending effortlessly, and automate your savings using readily available digital resources. Mastering digital financial management is the key to achieving your financial goals and building a secure future.

Why Going Digital Improves Money Clarity

Switching to digital finance management offers unparalleled clarity over your financial situation. Digital tools provide a centralized, easily accessible view of all your accounts – checking, savings, credit cards, investments – eliminating the need to sift through scattered paper statements or mentally track balances.

This consolidated view facilitates better budgeting. You can instantly see where your money is going, identify areas of overspending, and make informed adjustments to your spending habits. Automated transaction categorization further enhances this process, saving you time and effort in manually tracking expenses.

Furthermore, digital platforms often offer robust reporting and analytics features. These tools provide insightful summaries and visualizations of your financial health, helping you understand spending patterns, track progress towards financial goals, and identify potential financial risks.

Finally, the security and accessibility offered by digital systems are significant advantages. Digital records are less prone to loss or damage compared to physical documents, and you can access your financial information anytime, anywhere with an internet connection.

Use a Budgeting App That Links All Accounts

One of the most effective ways to digitally organize your personal finances is to utilize a budgeting app that can link all your accounts. This provides a centralized view of your financial situation, eliminating the need to manually track transactions across multiple platforms.

Many budgeting apps offer this functionality, securely connecting to your bank accounts, credit cards, and investment accounts. This integration allows for automatic transaction tracking, saving you significant time and effort. The app will then categorize your spending, providing insights into your spending habits and helping you identify areas for potential savings.

By having all your financial data in one place, you can easily monitor your budget, track your progress towards financial goals, and make informed decisions about your spending. The real-time updates offered by these linked accounts ensure you always have an accurate picture of your finances.

Choosing a reputable app with strong security features is crucial. Look for apps with established privacy policies and robust encryption to protect your sensitive financial information. The convenience and insights offered by linked-account budgeting apps make them an invaluable tool for anyone looking to effectively organize their personal finances digitally.

Scan and Store Receipts in the Cloud

Transitioning to digital record-keeping for your finances offers significant advantages. One crucial aspect is effectively managing receipts. Instead of a cluttered physical filing system, consider scanning and storing receipts in the cloud.

Numerous apps and services provide secure cloud storage specifically designed for receipts. These platforms often allow for optical character recognition (OCR), automatically extracting key information like date, vendor, and amount from your scanned receipts. This makes searching and categorizing your expenses much more efficient.

The benefits of cloud-based receipt storage include easy access from any device, enhanced security against loss or damage, and improved organization compared to paper-based systems. Consider factors like cost, storage capacity, and security features when choosing a suitable service.

Proper organization is key. Establish a clear filing system, perhaps using date or category, to locate receipts quickly. Regularly review and archive older receipts to maintain efficient storage and reduce clutter. This streamlined approach simplifies tax preparation and overall financial management.

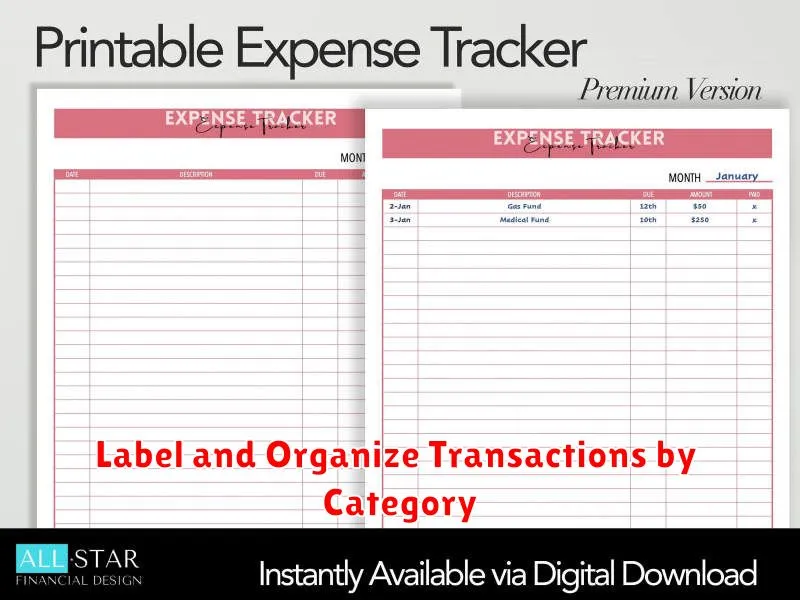

Label and Organize Transactions by Category

Effectively managing your personal finances digitally requires a robust system for categorizing transactions. This allows for insightful analysis of your spending habits and helps you identify areas for potential savings.

Categorization should be consistent and comprehensive. Most budgeting apps offer pre-defined categories like Groceries, Housing, Transportation, and Entertainment. However, you may need to create custom categories to reflect your specific spending patterns. For example, you might need categories for Subscriptions, Utilities, or Pet Expenses.

Consistent labeling is crucial. If you inconsistently label similar transactions (e.g., sometimes “Groceries” and other times “Food”), your financial overview will be inaccurate. Develop a clear system and adhere to it strictly.

Regularly review and refine your categories. As your spending habits evolve, your categories may need adjustments. This ensures the ongoing accuracy and usefulness of your financial data.

By diligently labeling and organizing your transactions by category, you gain a clear understanding of your financial health and empower yourself to make informed financial decisions.

Automate Bill Payments and Savings Transfers

Automating bill payments and savings transfers is a crucial step in organizing your personal finances digitally. This eliminates the risk of missed payments and late fees, while simultaneously fostering a consistent savings habit.

Many banks and financial institutions offer online bill pay services, allowing you to schedule payments in advance. You can set up recurring payments for regular bills such as rent, utilities, and subscriptions. This ensures timely payments without manual intervention.

Similarly, automating savings transfers involves setting up recurring transfers from your checking account to your savings account. This could be a fixed amount transferred weekly, bi-weekly, or monthly, or a percentage of your income automatically deposited into savings. This consistent approach significantly simplifies saving and helps you reach your financial goals faster.

Utilizing these automated features not only saves time and effort but also promotes financial discipline and helps you maintain a clearer overview of your finances. Explore your bank’s or financial institution’s digital tools to leverage these convenient features.

Create Financial Folders on Your Drive

Organizing your personal finances digitally begins with establishing a clear and efficient folder structure on your computer’s drive. This allows for easy access and retrieval of important documents.

Create a dedicated folder named “Financial Documents” or similar. Within this main folder, create subfolders for specific categories. These might include: Banking (for bank statements, online banking records), Investments (for brokerage statements, retirement account information), Taxes (for tax returns, W-2s, 1099s), Insurance (for policy documents), Bills & Expenses (receipts, invoices), and Loans (loan agreements, amortization schedules).

Consider further sub-categorization within these folders as needed. For example, the “Banking” folder could contain separate subfolders for each bank or financial institution. Consistent naming conventions will greatly improve searchability and organization.

Regularly review and maintain your folder structure. Delete outdated or unnecessary documents to prevent clutter and maintain optimal performance. A well-organized digital filing system is crucial for managing your personal finances effectively.

Back Up Financial Data Regularly

Regularly backing up your financial data is crucial for protecting yourself against data loss. This includes bank statements, tax documents, investment records, and any other important financial information you store digitally.

Consider using multiple backup methods. A cloud-based service offers offsite protection, while a local external hard drive provides a readily accessible backup. You might also explore using a combination of both for added security.

Establish a consistent backup schedule. Daily or weekly backups are ideal for frequently updated documents. For less frequently changing information, a monthly schedule may suffice. Automate the process whenever possible to ensure you don’t forget.

Secure your backups. Use strong passwords and encryption to protect your sensitive financial data from unauthorized access. Regularly review and update your backup strategy to account for changes in your financial situation and technological advancements.

The peace of mind provided by knowing your financial data is safely stored is invaluable. A robust backup strategy is an essential component of responsible digital financial organization.

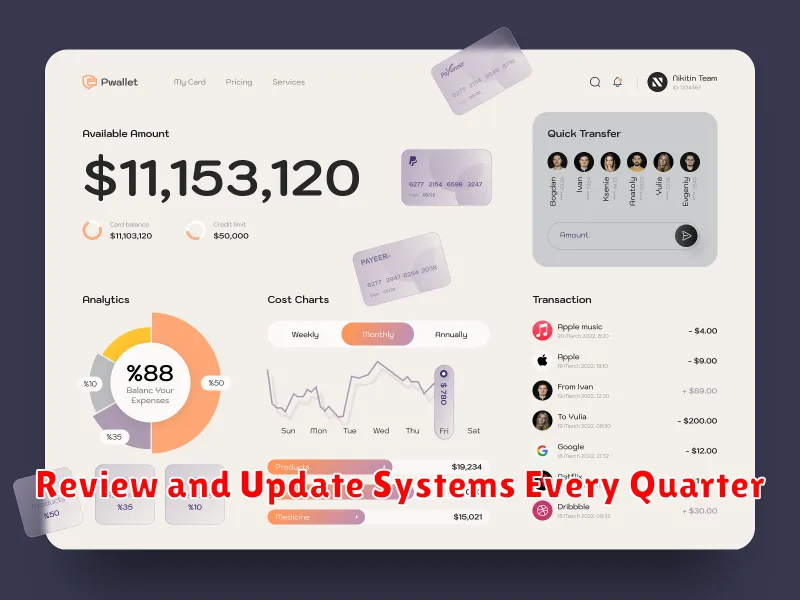

Review and Update Systems Every Quarter

Regularly reviewing and updating your digital personal finance systems is crucial for maintaining accuracy and effectiveness. A quarterly review allows you to catch errors early, ensure data consistency, and adapt to changing financial circumstances.

During your review, reconcile your accounts, comparing your digital records with bank and credit card statements. Identify and correct any discrepancies. This process helps prevent larger issues from developing.

Update your budget based on your spending patterns over the past quarter. Adjust categories as needed to reflect current realities. This ensures your budget remains a relevant tool for financial planning.

Review your financial goals. Are you still on track? Do your goals need adjusting? Quarterly reviews provide opportunities to assess progress and make necessary adjustments to your financial strategies.

Finally, evaluate the efficiency of your chosen digital tools and systems. Are they meeting your needs? Consider upgrading or switching to different software if necessary to improve organization and streamline your processes. This proactive approach ensures you maintain control of your finances.