Feeling financially lost? Struggling with debt, low income, or simply unsure of your financial future? You’re not alone. Many people experience periods of financial uncertainty, but taking proactive steps can help you regain control. This article outlines practical steps to take when you feel lost financially, providing a roadmap to financial stability and peace of mind. Learn how to budget effectively, manage debt strategically, and plan for a secure financial future.

Acknowledge Where You Are Without Shame

Facing financial hardship can be incredibly daunting, often accompanied by feelings of shame and inadequacy. However, the first crucial step towards regaining control is to honestly assess your current financial situation without judgment. This means acknowledging your debt levels, income, and spending habits, regardless of how uncomfortable it may feel.

Avoid denial. Minimizing the problem or pretending it doesn’t exist only prolongs the struggle. Be brutally honest with yourself. Create a detailed budget, listing all sources of income and every expense, no matter how small. This provides a clear picture of your financial reality, allowing you to start formulating a plan for improvement.

Remember, seeking help and acknowledging your current position is a sign of strength, not weakness. Many people experience financial difficulties, and there is no shame in needing assistance to navigate these challenges. Accepting your current situation is the foundation for making positive changes.

List Everything You Know About Your Money

The first step to regaining control of your finances is to create a comprehensive inventory of your current financial situation. This involves listing every asset and liability you possess.

Start by listing your assets: This includes cash on hand, checking and savings account balances, investments (stocks, bonds, retirement accounts), real estate, vehicles, and any other valuable possessions. Be as precise as possible with the figures.

Next, meticulously document your liabilities: This encompasses all outstanding debts, such as credit card balances, loans (student loans, auto loans, mortgages), and any other outstanding bills. Note the total amount owed and the interest rates for each debt.

Finally, calculate your net worth by subtracting your total liabilities from your total assets. This provides a snapshot of your overall financial health. While this number may be daunting initially, it serves as a crucial baseline for future financial planning and progress tracking.

Remember to be honest and thorough. The accuracy of this inventory is vital for effective financial management. Consider using a spreadsheet or budgeting app to organize your information effectively.

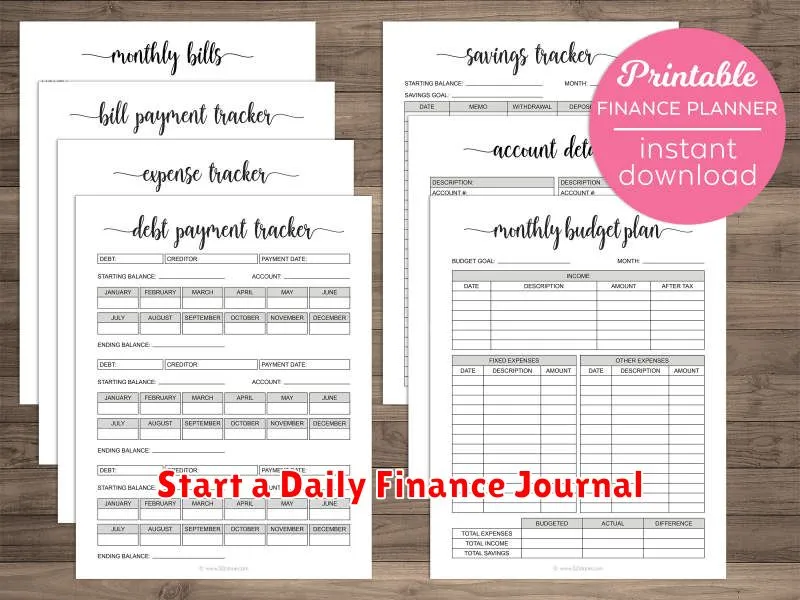

Start a Daily Finance Journal

Feeling lost financially can be overwhelming, but taking control of your finances starts with awareness. A daily finance journal is a powerful tool for achieving this.

Begin by simply recording your daily income and expenses. Note the source of income and the purpose of each expense. Be detailed; even small amounts matter.

Next, categorize your expenses. This will reveal spending patterns and highlight areas where you might be overspending (e.g., entertainment, dining out, subscriptions).

Over time, analyzing your journal entries will give you a clear picture of your financial health. You’ll identify areas for improvement and track your progress towards your financial goals.

The consistency of daily entries is key. The more data you collect, the more insightful your analysis will become. Consider using a simple notebook, a spreadsheet, or a dedicated finance app.

Remember, the goal is not to judge yourself, but to gain understanding. Your journal is a tool for self-discovery and improvement on your financial journey.

Talk to Someone You Trust About Your Finances

Feeling overwhelmed by your finances? Talking to someone you trust is a crucial step. This could be a spouse, family member, close friend, or even a financial advisor. A trusted confidant can provide emotional support and a fresh perspective on your situation.

Objectivity is key. A trusted person can help you identify areas where you might be overspending or mismanaging your money, offering insights you might miss while struggling emotionally. They can help you prioritize your financial goals and provide encouragement to stick to a plan.

Remember, seeking help is a sign of strength, not weakness. Opening up about your financial struggles can ease the burden and empower you to make positive changes. Choose someone who is a good listener and offers constructive feedback, not judgment.

Create a Small Goal and Reach It Within 7 Days

Feeling lost financially can be overwhelming. To regain a sense of control, start with a small, achievable goal you can accomplish within seven days. This short timeframe provides quick wins and builds momentum.

Example Goals: Creating a simple budget, contacting one creditor to discuss payment options, identifying one area where you can cut expenses (e.g., reducing daily coffee purchases), researching free financial resources online, or saving a small amount of money (even $10).

Action Steps: Break your chosen goal into daily tasks. For example, if your goal is to create a budget, one day might involve listing all income sources, while another focuses on categorizing expenses. Track your progress daily to stay motivated.

Celebrate Success: Acknowledge your accomplishment at the end of the week. This reinforces positive behavior and builds confidence to tackle larger financial challenges.

Important Note: Choose a goal that aligns with your current capabilities and avoid setting yourself up for failure. Small victories are crucial when navigating financial uncertainty.

Use Free Online Courses to Build Financial Knowledge

Feeling lost financially can be overwhelming, but taking control of your knowledge is a crucial first step. Free online courses offer a readily accessible path to building a solid financial foundation. Platforms like Coursera, edX, and Khan Academy provide a wide range of courses covering various aspects of personal finance.

These courses often cover essential topics such as budgeting, saving, investing, debt management, and retirement planning. Learning these concepts can empower you to make informed financial decisions and improve your overall financial well-being.

By dedicating time to these free resources, you can gain a better understanding of financial principles, develop practical skills, and build the confidence needed to navigate your financial situation. Remember to choose courses relevant to your current needs and learning style.

While free courses offer a great starting point, remember that they are often not a replacement for professional financial advice. Consider supplementing your learning with other resources, such as books, podcasts, or consultations with a financial advisor for personalized guidance.

Simplify: One Account, One Budget, One Goal

Feeling lost financially can be overwhelming. A key step to regaining control is simplification. Start by consolidating your finances into one primary checking account. This eliminates the confusion of tracking multiple balances and makes budgeting far easier.

Next, create a single, realistic budget. Use a budgeting app or spreadsheet to track income and expenses. Categorize your spending to identify areas where you can cut back. Be honest with yourself about your spending habits.

Finally, define a clear financial goal. Whether it’s paying off debt, saving for a down payment, or building an emergency fund, having a specific objective provides focus and motivation. Track your progress regularly and adjust your budget as needed.

By streamlining your finances with one account, one budget, and one goal, you create a clear path toward financial stability and alleviate the stress associated with financial uncertainty. This simplified approach allows for better monitoring and control of your funds.

Celebrate Small Wins to Build Momentum

Feeling lost financially can be overwhelming. It’s easy to focus on the large, daunting goals and feel discouraged by the perceived distance to them. However, shifting your perspective to acknowledge and celebrate small wins is crucial for building momentum and maintaining motivation.

Each step forward, no matter how seemingly insignificant, contributes to your overall progress. Paying off a small debt, sticking to a budget for a week, or even saving a few extra dollars—these are all achievements worth celebrating. Acknowledge your effort and reward yourself appropriately (without undermining your financial goals!).

This positive reinforcement helps build confidence and encourages you to continue working towards your financial objectives. By focusing on the progress you’re making, rather than solely on the remaining distance, you cultivate a more positive mindset and increase your likelihood of success. Remember, consistent small wins accumulate into significant long-term progress.

Tracking your wins, whether through a journal, spreadsheet, or app, can also be highly beneficial. Visualizing your progress can further boost your motivation and remind you of how far you’ve come, strengthening your resolve to keep moving forward.